Whisky is one the most profitable investment class of alternative assets. For many years, rates of return on investment in whisky have been very high, beating other alternative investments, such as rare coins, wine, art and watches. One of the indexes tracking the price of whisky at auctions – Knight Frank Rare Whisky Index gained as much as 478% in a 10-year perspective. Another indicator, the Rare Whisky Icon 100 Index, examining the price of one hundred most desirable whisky bottles, achieved an increase of over 13% over the last 12 months

Supply

Limited whisky supply

All available data indicate that the supply of Scotch whisky is not keeping pace with growing demand. Despite the growing number of distilleries and the plans of many distilleries to increase production, it seems that this trend is not endangered in the long run.

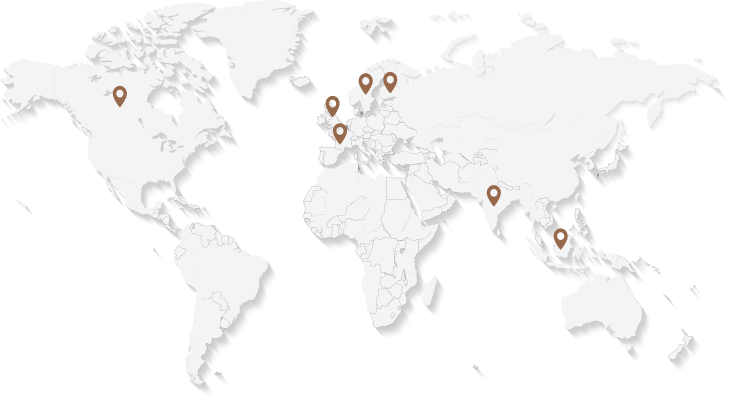

Investors from Asia have an undoubted impact on the market – according to Scotch Whisky Association, sales to Taiwan, India and Japan in the first half of 2019 increased by 22, 19.7 and 16.1% respectively. At the same time, single malt whisky deliveries to these countries account for almost 30% of total export.

Assests

Purchase of physical assets

By investing in a cask of Scotch whisky, you become the owner of physical assets. Investors receive a full description, along with information about the number and storage location of specific casks. The casks are insured and stored in a distillery in Scotland. At any time, investors can see their assets with their own eyes. The experience of Scottish distilleries guarantees storage under ideal conditions that ensure the safety and proper aging process of the distillate. The customer can finish the investment at any time and sell their assets.

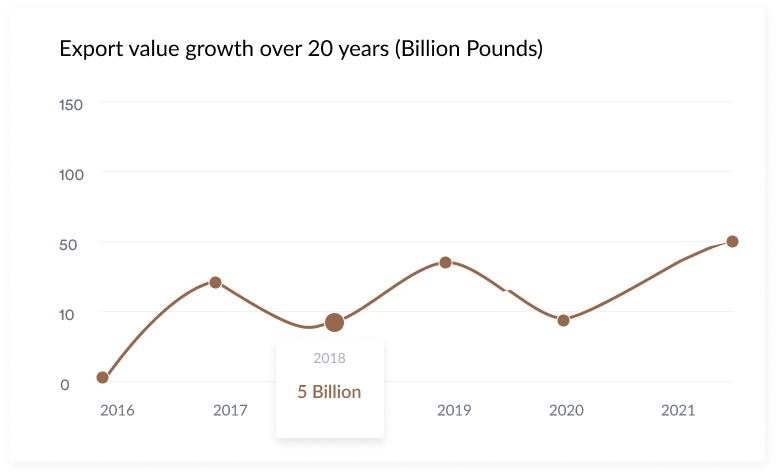

A market in numbers

The global demand for scotch whisky

outstrips supply.

£4.9bn

annual export value

42

bottles exported Every second

200

markets whisky is shipped to around the world

21%

accounts to the uk food and drink exports