At the end of the 15th century, a monk from Fife mentioned whisky for the first time. In 1494 he bought over a ton of malt to make the water of life. However, the beginning of the whisky market dates back to 1831, when it was allowed to produce it on an industrial scale. The industry developed quickly. The production collapsed in 1919, when prohibition began in the United States, which resulted in a sharp drop in sales. After 13 years, with the end of prohibition, whisky began its second youth. Today, as the sales and export results show, its popularity in the world is steadily growing.

Cask Whisky

History

Market

Market Situation

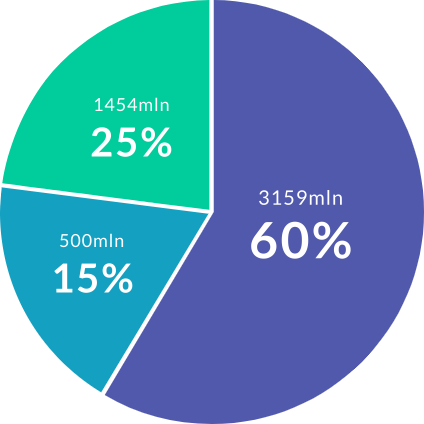

The Scotch Whisky Association, citing the HM Revenue & Customs (HMRC) data, announced that Scotch whisky exports increased over the 15-year period by over 60%, growing on average 3.19% per year (CAGR 2005-2020). Currently, the global export value of Scotch whisky is 3.8 billion pounds.

Meanwhile, the equivalent of 1.14 billion 0.7 cl bottles of whisky was sent abroad in 2020. In 2019, Scotch whisky accounted for 75% of Scottish food and drink exports, 21% of all UK food and drink exports and 1.4% of all UK goods exports.

The value of whisky casks is also growing rapidly, which

makes them one of the most profitable investments

In mid-2014 at an auction in Hong Kong, the Macallan cask from 1991 was auctioned for over 1.9 million HK$. Whisky from the auctioned cask can be poured into 490 bottles, if of course the buyer decides to do so. In 2017, the 30-year-old Macallan cask was sold for around $375,000 at the Spink auction in Hong Kong. At the end of 2018, at another Hong Kong auction, a 22-year-old Macallan cask from 1996 hit the hammer. It was sold for over GBP342,000 – the price that exceeded expectations. Initially, the estimated price of the cask was to reach a maximum of 280,000.

One of the main reasons for such high prices at auctions are significant deficits of whisky casks aged over 12 years. As promised by key distilleries, we should expect to return to bottling whisky, as 12 and older editions, over the next 5-8 years, as soon as the current stocks of whisky maturate. The result will be a very significant increase in the price of 12-year-old and older whisky. We are already observing serious price movements on the example of older whisky, where limited editions in the last 2-3 years have gained in price in most cases by a minimum of several dozen percent. This trend will translate into the cask market with a delay of 5-7 years. At the same time, owners of 3-5-year-old casks treating their wallets as a long-term investment will benefit most.

Over the past 10 years, rare whisky prices are up 582% according to Knight Frank Wealth Report